Fees (T&R) Overview

Basic Fees

Basic fees are charged when titling and/or registering a vehicle, trailer, or semi-trailer. The fees charged depend on:

- The body style

- The use of the vehicle

- Where the vehicle is located or driven (Phoenix, Tucson, Flagstaff, etc.)

- The year of the vehicle

- Ownership of the vehicle

- Transferring a plate

The AQCF of $0.25 is charged on all motorized vehicles :

- Being used in a non-attainment areas (emissions Areas A & B) OR

- Being used to commute from an attainment area to a non-attainment area

- For instance a person that drives from Flagstaff to Phoenix every day for work or school

The AQCF is payable, when applicable, once per registration, regardless of how many years a vehicle will be registered.

The AQF is charged on all motorized vehicles regardless of location.

- $1.50 is for a one year registration

- $3.00 is for a two year registration

- $7.50 is for a five year registration

|

|

The AQF will not be charged on electrically powered golf carts or electrically powered vehicles. |

The DSL is charged on all diesel-powered vehicles with a declared gross weight of over 8,501 lbs.

- $10.00 is for a one year registration

- $20.00 is for a two year registration

- $50.00 is for a five year registration

Postage fees will vary depending on the item(s) being mailed.

PST will typically only be charged with mailing registration forms, registration tabs, registration renewals, or plates.

|

|

Customers receiving a mailed (not emailed) registration renewal notice will be charged postage for both the mailed registration renewal notice and the registration document/license plate tab. |

PST cannot be charged when only mailing a title, per A.R.S. 28-2151 and R171-204.

The $12 Registration Credit Fee is charged when applying a credit plate to another vehicle or requesting a registration credit.

The REG fee is charged for each registration that is issued to a vehicle based on the vehicle body style.

- Vehicles - $8.00

- Motorcycles - $9.00

- ATVs - $9.00

- Exception: Off-Road vehicles declaring usage as Primarily Off-Highway will not be charged a REG fee

- Moped - $5.00

- Golf Carts - $8.00

- Travel Trailers - $8.00

- For exceptions, view the table listed in the Travel & Tent Trailers topic

The REG is payable once per registration, regardless of how many years a vehicle will be registered.

The $4 TTL fee is charged when ownership is changing. However, there are exceptions. View the below table for more information.

ADOT is moving towards full eTitle implementation, meaning no paper titles will be produced. Currently title fees in the legacy system are based on when the title is first issued and subsequently when the title is printed a second time. This practice will need to change in a paperless title world. Shifting to a paperless title standard can remedy the inconsistencies in how the title charge is applied. Please refer to the table below to determine when to charge title fees.

|

Action |

Result |

| Creation of the title record (initial, transfer, modification of ownership, including adding a lien) | Charge title fee |

| Modification of brands – add or end date | Charge title fee |

| Add a lien after initial title with no ownership change – Adding a lien after initial title recorded (ex: title loan). | Charge title fee |

| Release of lien | Charge title fee |

| Reassignment of title (DRT) | Do not charge title fee |

| Printing of Title at the owner’s request at ADOT central print | Charge title fee |

The PEN fees are assessed when a title service is not completed in the allotted time period as required per Arizona State Law.

- A motor vehicle dealer is given 30 days after the purchase or transfer of a vehicle which to apply for a title on behalf of the purchaser or a penalty fee will be assessed

- Once the vehicle is sold to a bona fide purchaser, a dealer has 30 days in which to submit the service, T&R Application (Single), form #96-0236, and all other required supporting documentation)

The PEN is $8 for the first month of delinquency, with $4 being charged for each additional month. The PEN fee will not exceed $100.

|

|

This penalty process does not apply to an out-of-state title transfer. |

A late title transfer penalty fee is waived when:

- Transferring a vehicle with an out-of-state title

- A Statement of Error, form #46-0307 is filled out from the original owner regarding the Sale Date

- Adding or deleting a name

- Transferring a title into the name of the lienholder, as a result of a repossession

- The applicant had no control of the delay

- A vehicle owner who has encountered a delay as a result of having to comply with the requirements of obtaining a bonded title

The $12 Plate Transfer fee is charged when transferring a special and/or personalized plate OR when transferring a Noncommercial Trailer.

This fee varies based on the assessed value and depreciates with every consecutive renewal.

- $10.00 VLT is the minimum for one year registration for a non-Alternative Fuel Vehicle, Alternative Fuel (Tier 3), or a plug-in hybrid electric vehicle

- $5.00 VLT is the minimum for one year registration for an Alternative Fuel Vehicle (AFV) (Tier 1 and Tier 2)

- $3.00 VLT is the minimum for one year registration for an off-road vehicle declaring usage as Primarily Off-Highway on the Off-Highway Vehicle Decal Application, form #96-0572

|

|

View the Vehicle Fuel Types topic > Alternative Fuel Vehicle Fees section for new information on how VLT will be calculated for alternative fuel vehicles starting January 1, 2022. FAQ regarding these changes is available on azdot.gov. |

(MSRP x 60% divided by 100) x $2.80 (new) or $2.89 (used)

Other Title or Registration Associated Fees

The Division offers special plates that represent, but is not limited to, colleges, the environment, and organizations. Some special plates can be personalized, have the disability symbol, and/or have eligibility requirements.

View the Vehicle License Plates topic for more information on personalized or special plates.

Depending on the declared gross weight and the usage of the trailer, trailers may have a wide range of VLT or REG fees to be charged. View the Non-Commercial & Commercial Trailers topic or the Travel & Tent Trailers topic for more information on fees.

The Vehicle Use Tax(VUT) consists of state tax (more commonly known as Department of Revenue (DOR) Tax) and city tax.

When a vehicle is purchased by an Arizona resident from an out-of-state dealer and the customer did not pay sales tax or did not pay sales tax equal to or greater than Arizona State sales tax rate; the customer must pay the tax or additional tax when they title and/or register the vehicle in Arizona.

- Purchased outside of Arizona: An Arizona resident purchased a vehicle from a dealer or manufacturer located out-of-state or a foreign country

- The term 'Resident' includes individuals, commercial entities, state, county and city agencies and political subdivisions

- Non-resident business: A nonresident of Arizona who is using the vehicle in Arizona and conducting business in Arizona

- Dealer: An Arizona dealer purchased a vehicle from out-of-state that is to be titled and registered in the name of the dealership

- Lease buy-out: A person that purchases their vehicle at the end of a lease, called a 'lease buy-out', from an out-of-state leasing company and wants to title and/or register the vehicle in Arizona

- Purchases in Arizona: When an Arizona resident purchases a vehicle from an Arizona dealership, do not collect state or city taxes. The Arizona resident is not required to show proof of taxes paid when processing the title work. In these situations, it is the responsibility of the Arizona dealerships to collect the state (DOR) tax and the city tax.

- Casual sale: A person purchases a vehicle from a seller as 'casual' sale (e.g., sale between two individual private parties)

- Including foreign vehicles purchased between private parties

- Paid enough out of state: A person paid sales tax in the state where they purchased the vehicle, and the tax paid is equal or greater than 5.6%

- Leasing business: A licensed leasing company owns the vehicle and the leasing company Is applying for title in its own name (reasoning is – the leasing company will use the vehicle for business purposes)

- Arizona Dealer: An Arizona licensed dealer acquired a vehicle for resale purposes and registration is not requested

- Native American: An enrolled member of a Native American tribe who lives on that tribe’s reservation

- Requirement: A completed and signed Vehicle License Tax Tribal Exemption, form #48-7701 is required

- Special Organization: A qualifying hospital, health care organizations or nonprofit charitable organizations

- Requirement: Must present a copy of the ADOR exemption letter at the time of application for the exemption

- Purchased vehicle at auction: Arizona resident purchased a vehicle at auction and was given an out-of-state title with an invoice indicating they paid equal or greater to Arizona's 5.6% rate

- Federal Government Agency: For federal agencies purchasing a vehicle

A completed and signed ADOR Transaction Privilege Tax Exemption Certificate Form 5000 is required when the applicant is claiming nonresident status or an exemption that is not identified in the previous section.

The Form 5000 will be sent to ADOR when submitted for the exemption.

The state (DOR) tax rate is equal to 5.6% of the total vehicle price, including additions that make the vehicle more valuable and less any deductions. The total vehicle price may be obtained from any one of the following documents:

- A copy of the purchase invoice

- Copies of the lending contract

- A letter from the dealership or manufacturer

Any of the above documents should:

- Describe the vehicle by VIN, year, and make

- Show the purchase price separate from any sales tax paid

- The dealership invoice showing a 'grand total' needs to have the sales tax listed separately to show the purchase price of the vehicle

It is the responsibility of the applicant to show proof the tax has already been paid. Unless proof of payment is established, the applicant must pay the state (DOR) tax and city tax.

|

|

If there is not a total vehicle price listed on any of the acceptable documents listed above, and only the MSRP price of the vehicle is on the document, the MSRP can be used to calculate the state (DOR) tax and city tax. On the Title Summary page, write down how the FLP was established. |

The documentation used to determine the VUT will need to be submitted.

Items that you can touch and are physically added to the vehicle are additions that make a vehicle more valuable. These can be, but are not limited to:

- Leather packages

- Alarm systems

- Sound systems

Items that do not make the vehicle more valuable and cannot be added to the total vehicle price can be, but are not limited to:

- Dealer documentation fees

- Preparation fees

- Labor fees

- Gap insurance

When determining the total vehicle price, the Arizona Department of Revenue (ADOR) allows the Division to subtract any allowable deductions. When subtracted on a purchase invoice, the following deductions are allowed:

- Total trade-in allowance (ignore lien pay off amounts)

- Manufacturer’s cash rebate when the purchaser assigns the rights in the rebate to the dealer

Once the total vehicle price, including any additions or deductions is determined, the state (DOR) tax will be calculated by MAX.

When processing a title transaction dealing with state (DOR) tax, the amount calculated to charge the 5.6% of state (DOR) tax will be different than the FLP used to calculate the VLT for registration fees.

The VLT is based off the manufacturer base retail price (MBRP, the vehicle with NO additions or deductions, or FLP) of the vehicle.

The state (DOR) tax price is based off the actual total vehicle price paid for the vehicle, (including additions and deductions).

The Division may also collect city tax on behalf of ADOR. The city tax rate is based off:

- Where the vehicle was purchased out-of-state

- Where the vehicle will be registered in Arizona

The city tax will not always be collected, it will depend on the information entered into MAX when determining VUT and not all Arizona cities will have a city tax due. The reason is every city's tax rate is different and we are not required to know them.

|

|

Every city has a different tax rate and the Division is not required to know them. MAX will automatically calculate for the proper city. |

When Arizona residents purchase a vehicle in a foreign country from a dealer or manufacturer, the vehicle is not being registered or is registered for less than 3 months in the foreign country, the purchaser:

- Will not receive credit for any tax paid to another country

- Will receive a $200 deduction for imports from the vehicle price

- Once the vehicle price is determined, deduct the $200 from the vehicle price, and then determine the state (DOR) tax

- The vehicle price is equal to the average retail value for the vehicle

- The average retail value may be established from information in the N.A.D.A. Official Used Car Guide or any similar publication

- The state (DOR) tax rate is equal to 5.6% of the average retail value

- Full payment of the state (DOR) tax is collected, regardless of any taxes that may have been paid

- Be sure to click the checkbox to indicate the 'vehicle was purchased out of country' to have the $200 deduction automatically applied

- When using the Vehicle Use Tax Calculator to calculate VUT outside of a MAX service for calculating the state (DOR) tax, the CSR shall reduce the vehicle price by the $200 from the vehicle price prior to calculating the tax

When a customer claims they have paid too much in state (DOR) tax, they can request a refund by completing the VUTR Form - Claim for Refund of Vehicle Use Tax Paid at ADOT - Motor Vehicle Division.

The fillable form can be found on the ADOR website www.azdor.gov. Customer can contact the ADOR to inquire if they will be eligible for a refund at [email protected] or call 602-716-6450.

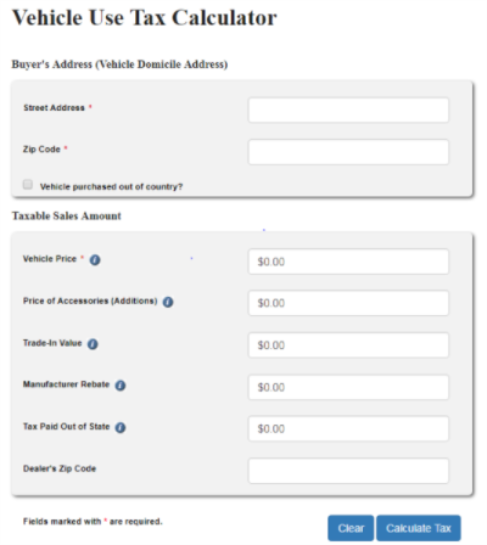

Arizona cities and towns have different tax rates, so the Arizona Department of Revenue (ADOR) has created an online Vehicle Use Tax (VUT) Calculator to assist MVD in calculating the Vehicle Use Tax (state (DOR) and city taxes).

While MAX "speaks" to the ADOR's Vehicle Use Tax Calculator, it may not be able to pin point the proper address to calculate the city tax, therefore, only DOR Tax will be calculated and collected. ADOR will contact the customer for the payment of city taxes.

If a Title service is not being completed and the customer wants to know what the fees will be, or if it is decided to verify a discrepancy when city tax is not calculated by MAX, view this Vehicle Use Tax Calculator section on how to calculate the VUT.

Information Required for VUT Calculator:

The required information to be entered into the Vehicle Use Tax calculator is:

- The Buyer’s Address (Vehicle Domicile Address); including Zip Code

- If the buyer/customer has a different residence and vehicle domicile address, the vehicle domicile address where the vehicle will be located, will be entered into this field

- Vehicle Price (total vehicle price)

Additional information that may be entered depending on the buyer/customer’s situation:

- If the vehicle was purchased out-of-country, the box 'Vehicle purchased out of country' box will need to be checked

- Price of Accessories (Additions); discussed in the Additions to Total Vehicle Price section

- Trade-In Value; discussed in the Deductions from Total Vehicle Price section

- Manufacturer Rebate; if rights are reassigned back to the dealer; discussed in the Deductions from Total Vehicle Price section

- Tax Paid Out of State*; if the customer paid any taxes to the out-of-state dealership (does not include if the vehicle was purchased out-of-country)

- Dealer’s Zip Code; zip code of the out-of-state dealership

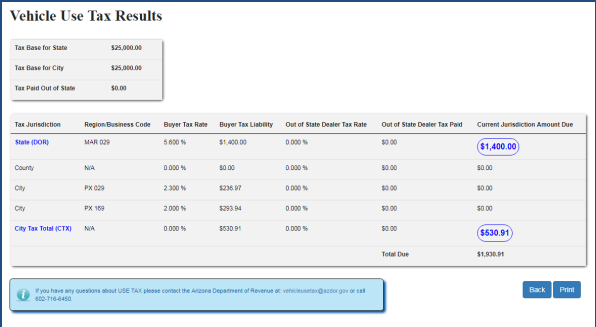

After all applicable information is entered in the Vehicle Use Tax Calculator, click the Calculate Tax button and the Vehicle Use Tax Results page will display showing the amount of state (DOR) and city tax due.

|

|

*When a customer has a lending contract that indicates taxes were paid and the dealer submits a check to us (the Division) for the taxes that are listed on the lending contract, this indicates the taxes are to be paid to Arizona and no taxes paid out-of-state should be inputted into the VUT Calculator or used in a manual calculation of the State (DOR) tax. |

However, if the lending contract does show taxes paid and no check is provided, you will enter the amount in the 'Tax Paid Out of State' field in the VUT Calculator, as this will indicate taxes were really paid and kept in that state.

When using the Vehicle Use Tax Calculator and state (DOR) tax was paid out-of-state, the Dealer’s zip code and amount of tax paid must be entered for a credit to be applied for the taxes paid.

If the Dealer’s zip code is not available:

- The transaction will still be processed with no deductions of the taxes paid out-of-state

- The Vehicle Use Tax Results page will then be printed and given to the customer

- The customer will be required to contact the ADOR to receive a credit for the taxes paid out-of-state

At no time should a CSR try to explain the Vehicle Use Tax Results page from the Vehicle Use Tax Calculator to the customer. If a customer is questioning the tax amounts due:

- The results page may be given to the customer

- The customer will be required to contact ADOR at 602-716-6450 for an explanation

Policies

8.14.8 Public Safety Fee

Forms