Non-Commercial & Commercial Trailers

The Division is authorized to title and register both non-commercial and commercial trailers. Therefore, depending on the declared gross weight and use of the trailer, customers are issued either a permanent or annual registration.

Permanent Trailers

Non-commercial and commercial trailers qualify for permanent registration.

Non-commercial permanent trailers are used for personal use and will have a declared gross weight between 1 to 10,000 lbs., while commercial permanent trailers are used for business use and will have a declared gross weight of 10,001+ lbs.

Permanent Registration Requirements

The requirements for issuing a permanent registration to a trailer are as follows:

- The customer must always declare the weight

- Customers with non-commercial permanent trailers less than 10,000 lbs. must certify the trailer will not be used for business or commercial enterprise either by checking the appropriate box on the T&R Application (Single), form #96-0236 or by completing the Noncommercial Use Certificate, form #96-0461

Permanent registration fees will be paid once as long as use and ownership remain the same. Depending on the use and declared gross weight determines if commercial or non-commercial permanent registration fees will be charged.

Use the following chart to determine fees for a trailer with a declared gross weight of 1 to 10,000 lbs. and is used for personal use:

| Vehicle License Tax | Registration Fee | Public Safety Fee | Title Fee | When is it Charged? |

| $105 | $20 | $32 | $4 |

|

| $70 | $5 | $32 | $4 |

|

Use the following chart to determine fees for a trailer with a declared gross weight of 10,001+ lbs. and/or is used for business or commercial purposes:

| Vehicle License Tax | Registration Fee | Public Safety Fee | Title Fee | When is it Charged? |

| $555 | $245 | $32 | $4 |

|

| $355 | $145 | $32 | $4 |

|

| $100 | $95 | $32 | $4 |

|

The following trailers will be also be assessed initial permanent registration fees:

- The owner of a trailer with a current non-permanent registration and who is increasing the declared gross weight to a weight of 10,001+ lbs., or decreasing the declared gross weight to a weight of 10,000 lbs. or less, shall be assessed an initial permanent registration and Vehicle License Tax (VLT) fee

- A trailer record displaying a Title Only status, will be assessed an initial permanent registration and VLT fees upon being registered

Permanent registration means fees are paid only once as long as use and ownership remain the same (i.e. the vehicle is not sold) and subsequent registration and VLT fees are not required.

However, the permanent registration becomes fully permanent after two years (24 months) from when the initial permanent registration fees were paid, which can be determined from the Perm Reg Date.

|

|

Perm Reg Dates will always be the last day of the month, and one month forward from the date the initial permanent registration fees were paid. |

|

|

Perm Reg Date is June 30, 2019 Trailer will become fully permanent in May 2021 |

MAX will calculate the appropriate registration fees when the service is being processed; however, if a customer asks how the fees are calculated, the below information will assist in manually calculating the VLT.

The main item needing to be determined is the proration of the VLT, which is based off the initial VLT paid and the number of months remaining from the initial payment of permanent registration fees.

With the following information the prorated VLT can be determined:

- Perm Reg Date

- Initial VLT paid

- Date of one month forward from the date of sale and current year

- Permanent Trailer VLT Proration Chart

|

Commercial Permanent Trailers Fee based on original VLT of: |

Non-Commercial Permanent Trailers Fee based on original VLT of: |

||||||

| Months | 555.00 | 355.00 | 100.00 | Months | 105.00 | 70.00 | |

| 24 | 555.00 | 355.00 | 100.00 | 24 | 105.00 | 70.00 | |

| 23 | 531.88 | 340.21 | 95.83 | 23 | 100.63 | 67.08 | |

| 22 | 508.75 | 325.42 | 91.7 | 22 | 96.25 | 64.17 | |

| 21 | 485.63 | 310.66 | 87.50 | 21 | 91.88 | 61.25 | |

| 20 | 462.50 | 295.83 | 83.33 | 20 | 87.50 | 58.33 | |

| 19 | 439.38 | 281.04 | 79.17 | 19 | 83.13 | 55.42 | |

| 18 | 416.25 | 266.25 | 75.00 | 18 | 78.75 | 52.50 | |

| 17 | 393.13 | 251.46 | 70.83 | 17 | 74.38 | 49.58 | |

| 16 | 370.00 | 236.67 | 66.67 | 16 | 70.00 | 46.67 | |

| 15 | 346.88 | 221.88 | 62.50 | 15 | 65.63 | 43.75 | |

| 14 | 323.75 | 207.08 | 58.33 | 14 | 61.25 | 40.83 | |

| 13 | 300.63 | 192.29 | 54.17 | 13 | 56.88 | 37.92 | |

| 12 | 277.50 | 177.50 | 50.00 | 12 | 52.50 | 35.00 | |

| 11 | 254.38 | 162.71 | 45.83 | 11 | 48.13 | 32.08 | |

| 10 | 231.25 | 147.92 | 41.67 | 10 | 43.75 | 29.17 | |

| 9 | 208.13 | 133.13 | 37.50 | 9 | 39.38 | 26.25 | |

| 8 | 185.00 | 118.33 | 33.33 | 8 | 35.00 | 23.33 | |

| 7 | 161.88 | 103.54 | 29.17 | 7 | 30.63 | 20.42 | |

| 6 | 138.75 | 88.75 | 25.00 | 6 | 26.25 | 17.50 | |

| 5 | 115.63 | 73.96 | 20.83 | 5 | 21.88 | 14.58 | |

| 4 | 92.50 | 59.17 | 16.67 | 4 | 17.50 | 11.67 | |

| 3 | 69.38 | 44.38 | 12.50 | 3 | 13.13 | 8.75 | |

| 2 | 46.25 | 29.58 | 8.33 | 2 | 8.75 | 5.83 | |

| 1 |

23.13 |

14.79 | 4.17 | 1 | 4.38 | 2.92 | |

|

|

Perm Reg Date is 04/02/2019 Initial VLT paid is $105.00 Date of Sale is 11/25/2019 - one month forward from date of sale is 12/2019 The Perm registration becomes fully permanent on 03/31/2021 (which is the month the initial permanent registration was paid). Therefore VLT needs to be collected from 12/2019 to 03/31/2021, which is 16 months. Take the initial VLT paid of $105 and the 16 months and go to the Permanent Trailer VLT Proration Chart. On the chart, locate the column that has 105.00 and locate the row that has the 16 months. The amount in the corresponding box is 70.00. This is the VLT to be collected, along with any other applicable fees. |

Use the following chart to determine fees for a trailer with a declared gross weight of 1 to 10,000 lbs. and is used for personal use. For non-commercial permanent trailers only, a $12.00Transfer fee is required to be charged.

|

Vehicle License Tax |

Transfer Fee |

Public Safety Fee |

Title Fee |

When is it Charged? |

|

Prorated VLT |

$12 |

$32 |

$4 |

|

|

N/A |

$12 |

$32 |

$4 |

|

Use the following chart to determine fees for a trailer with a declared gross weight of 10,001+ lbs. and/or is used for business or commercial purposes.

|

Vehicle License Tax |

Registration Fee |

Public Safety Fee |

Title Fee |

When is it Charged? |

|

Prorated VLT |

N/A |

$32 |

$4 |

|

|

N/A |

N/A |

$32 |

$4 |

|

- Historic trailers designed for commercial use, but not used in the furtherance of a commercial enterprise

- The historic commercial trailer must be a hobby vehicle (used only in antique truck shows and/or parades) and display a Historic Vehicle license plate

- The owner of the historic commercial trailer is NOT required to declare weight

- Travel trailer or tent trailer (view the Travel & Tent Trailers topic for more information)

- Commercially used trailers with a declared gross weight of 10,000 lbs. or less (view the Non-Permanent Trailers section for more information)

A trailer the customer declares holds more than 10,001 lbs. will require the declared gross weight to be entered as 10,001 during data entry on the Title and Registration record.

|

|

When a trailer is registered at 10,001 lbs., the weight of the trailer plus the load MUST be declared on the power unit (truck that is pulling the trailer). |

|

|

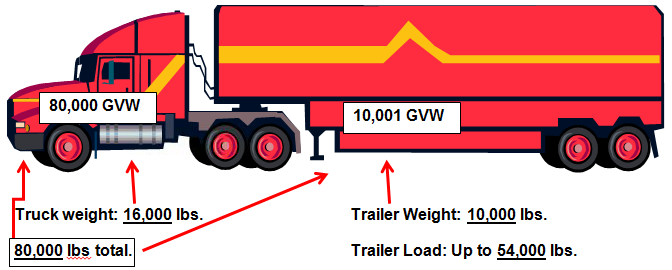

The truck below is registered at 80,000 lbs. and the trailer is registered at 10,001 lbs., with permanent registration. No commercial or weight fees are collected for the trailer, that is why the total weight is carried on the truck registration. Even though the trailer is registered at 10,001 lbs., it does not count toward the total weight of the truck, trailer, or its load. The 10,001 lbs. is only an indicator for the system that allows the trailer to be registered as permanent.

|

Non-Permanent Trailers

Commercial non-permanent (annually) trailers are trailers the customer declares will be used for business purposes or commercial enterprise but will be used at a lower declared gross weight than the commercial permanent (heavyweight) trailers.

The declared gross weight may be between of 1 to 10,000 lbs. and are titled and registered the same as a motor vehicle.

To register a commercial trailer:

- The customer MUST declare the weight between 1 to 10,000 lbs.

- The trailer MUST be registered in a business name, or being used for commercial purposes (to earn money)

The fees for a Commercial Non-Permanent trailer are the same as any commercial vehicle:

- Vehicle License Tax is determined by the Factory List Price and year of the trailer

- All applicable commercial fees are determined by the declared gross weight

- Air Quality Fees are not charged since the trailer does not have an engine

A trailer that is non-permanent and whose weight is either being increased or decreased shall pay an initial (used trailer) permanent registration fees.

Policies

8.2.2 Certificate of Title Without Registration (Title Only)

8.10.10 Trailer Title and Registration

8.12.2 Vehicle Verification Inspection

8.12.3 Arizona Serial Number (AZ SNO) and Reassigned Serial Number (Built-Up Number)

8.13.5 Reconstructed and Specially Constructed Vehicle

8.14.3 Commercial Registration and Weight Fees

8.14.4 Motor Carrier Fees

8.14.6 Registration Fees

8.14.8 Public Safety Fee

8.16.1 General License Plate Information

Forms

#48-5108 Special Serial Number Application

#96-0461 Noncommercial Use Certificate