Vehicle Fee Exemptions

An exemption releases qualified owner(s) of a vehicle from paying Vehicle License Tax (VLT), Registration fees, and commercial vehicle fees.

- The owner may be granted a full or partial exemption, depending on the type of exemption and the number of titled owners who qualify for the exemption

- When the vehicle is in the name of a lessor, the lessor is not included in determining the number of owners

- When a vehicle is in the name of the trust, no exemption applies

- If a trustee, or another qualified owner, is on the title, an exemption may be applied

|

|

All reduced VLT rates must be applied at the time of initial registration or registration renewal. Refunds will not be given unless it has been determined the VLT has been overpaid due to error. |

There are different kinds of exemptions for which a customer can qualify. Each exemption requires the applicant to have specific documentation as proof of eligibility.

Types of Exemptions

There are four categories of exemptions:

- Military/Public Health

- Non-Profit/Religious/School

- Owner Qualifier

- Vehicle Qualifier

An Arizona resident who is a member of the U.S. Armed Forces, including a National Guard or Reserve Unit, and who is within 30 days of deployment or is deployed in support of a worldwide contingency operation may register a newly acquired vehicle or renew the registration of a motor vehicle for one year without payment of registration and Vehicle License Tax fees. The surviving spouse or legally designated representative of a military member who has met the above requirements and who died or is listed as missing in action while serving on active military duty is eligible to claim this exemption.

The exemption:

- Is allowed only one time per deployment

- Applies to a one year registration

- Can be applied to two vehicles

- May be applied for during the time period between 30 days prior to the date of deployment and one year after the deployment ends, or the member is released from that duty

- Requires the Special Military Exemption, form # 96-0240, signed by the Commanding Officer or Judge Advocate

- Military orders are not required, but if the exemption form seems questionable, military orders may be requested

- Commander or Judge Advocate signatures do not have to be notarized or contain a raised seal

- Exempt from Air Quality Compliance Fee, Air Quality Fee, and postage/handling fees

A member of the US Armed Forces, who would otherwise qualify for the Special Military Exemption and whose registration fees and vehicle license taxes for a motor vehicle were paid during the time the member of the US Armed Forces was deployed is entitled to a refund of the current year's registration or they may choose to use the exemption on the next registration period for that motor vehicle.

|

|

Customer can only apply for a one-year registration when applying for the exemption during an initial registration or renewal. |

If customer is requesting a refund and the vehicle currently has a multi-year registration, the Division will only refund for the fees paid for the current registration year. Note: The registration expiration date will remain the same.

|

|

The current date is 10/25/2025. The customer renewed their registration for 5 years back on 05/01/2023, the registration now expires 05/15/2028. The refund will only be applied for the registration fees from 06/2025 - 05/15/2026. |

To qualify for the exemption, the member must submit the Special Military Exemption, form # 96-0240, signed by the Commanding Officer or Judge Advocate and military orders at the time of registration renewal and comply with all other requirements related Special Military Exemption.

A vehicle owned by a non-resident military member or officer of Public Health Services is exempt from VLT and Public Safety Fee.

|

|

The vehicle cannot be used in the furtherance of a commercial enterprise. |

- Cannot be a resident of Arizona

- Only applies to the non-resident military member's or officer's of Public Health Services interest in the vehicle, if the vehicle has two or more titled owners

- If a spouse is a titled owner, along with the non-resident military member, the spouse may qualify for the exemption. View the Non-Resident Military Spouse section for more information

- Must provide either:

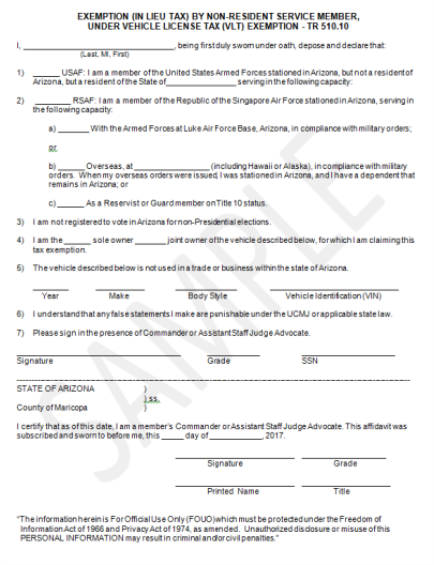

- An Affidavit for Exemption of Non-Resident Service Personnel

- The affidavit is issued and certified by the non-resident military member’s Commanding Officer or the Commanding Officer of a Public Health Center or Hospital, unit legal officer or Staff Judge Advocate (Base or Post Legal Officer)

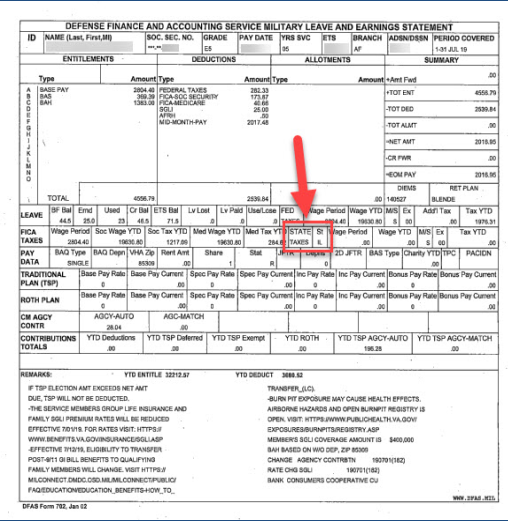

- A current Defense Finance and Accounting Service Military Leave and Earnings Statement (LES)

- The LES needs to show the military member is not having state taxes collected in Arizona (e.g., State Taxes block on the LES is blank or not displaying 'Arizona')

- An Affidavit for Exemption of Non-Resident Service Personnel

- To be eligible for the VLT exemption, they must:

- Maintain a permanent legal residence in another state

- Be assigned to military duty (stationed) in the state of Arizona

- When applying for Arizona registration, the out-of-state registration does not need to be current

- Re-certification is required on an annual basis and limited to a one-year registration

|

|

A Non-Resident Military Member/Health Services Officer stationed in Arizona is not required to obtain Arizona registration as long as the out-of-state registration remains current. |

A vehicle owned by a non-resident military member's or officer of Public Health Service's spouse may be exempt from VLT and Public Safety Fee.

|

|

The vehicle cannot be used in the furtherance of a commercial enterprise. |

- Cannot be a resident of Arizona

- Only applies to the spouse and the non-resident military member's or officer's of Public Health Services interest in the vehicle, if the vehicle is titled in the spouse's name, along with the non-resident military member

- Must provide either:

- Spouse's military ID (spouse is stated on the ID)

- Marriage certificate, along with the current Defense Finance and Accounting Service Military Leave and Earnings Statement (LES) for the non-residen military member

- The LES needs to show the military member is not having state taxes collected in Arizona (e.g., State Taxes block on the LES is blank or not displaying 'Arizona')

- To be eligible for the VLT exemption, they must:

- Maintain a permanent legal residence in another state

- When applying for Arizona registration, the out-of-state registration does not need to be current

- Re-certification is required on an annual basis and limited to a one-year registration

A vehicle acquired by financial aid from the Veteran’s Administration and is owned by a veteran will be fully exempt from both VLT and Public Safety Fee.

An eligible veteran:

- Must be a current resident of Arizona

- Must provide certification from the Veterans Administration (VA) indicating the veteran was granted a vehicle

- Can claim the VA Grant exemption during each registration cycle for only one vehicle or any replacement vehicle owned by the veteran

- A full exemption applies, regardless of the number of owners on the vehicle

- Re-certification is not required

|

|

If all other requirements have been met, the vehicle can be registered for a multi-year registration (two or five years). |

A vehicle owned by a 100% disabled veteran or their surviving spouse is exempt from both VLT and Public Safety Fee.

|

|

The vehicle cannot be used in the furtherance of a commercial enterprise. |

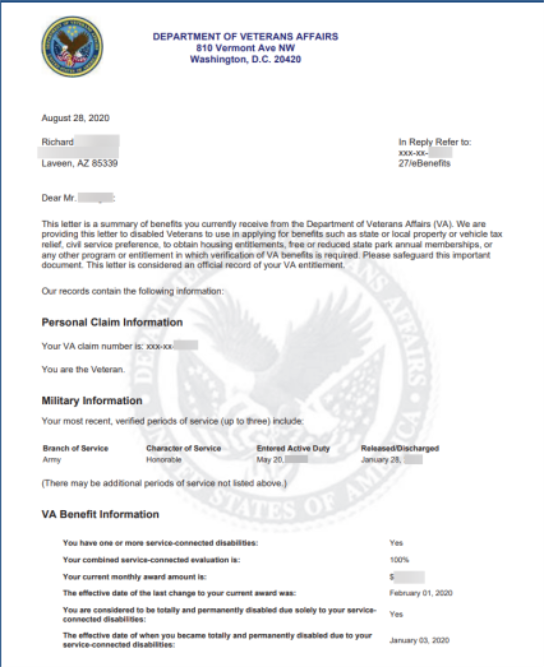

An eligible veteran:

- Must be a current resident of Arizona

- Must provide certification from the VA indicating the veteran is receiving benefits at the 100% disabled rate or an U.S. Department of Defense/Uniformed Services Sponsor Identification and Privilege Card with the 100% Disabled American Veteran affiliation

- A veteran who is rated at 60% or more disabled but receives compensation at a 100% due to unemployability is qualified for the exemption

- Can claim the exemption during each registration cycle for only one vehicle or any replacement vehicle owned by the veteran

- A full exemption applies, regardless of the number of owners on the vehicle

- This exemption applies to a surviving spouse of the disabled veteran until the surviving spouse’s remarriage or death. To receive the VLT and registration fee exemptions, the eligible spouse must present a 100% Disabled Exemption Renewal Affirmation issued by VA at the time of vehicle registration (re-certification required annually)

- Re-certification is not required unless a surviving spouse is applying for the exemption, then limited to a one-year registration

|

|

If all other requirements have been met, the vehicle can be registered for a multi-year registration (two or five years). |

Page One

Page Two

Beginning on or after 09/24/22, a vehicle or trailer that is owned or leased by a Purple Heart Medal Recipient is exempt from both VLT and the Registration fee.

An eligible Purple Heart Medal Recipient:

- Must show both proof of Purple Heart Award and honorable discharge. Examples of proof include but are not limited to:

- The DD-214, DD-215 or other discharge forms listing awards

- General or Permanent Orders

- Purple Heart Award certificate

- Must be on the title as owner or lessee

- Can claim the exemption during each registration cycle for only one vehicle or any replacement vehicle owned by the veteran

- A full exemption applies regardless of the number of owners on the vehicle

- Re-certification is not required, the vehicle can be registered for a multi-year registration (two or five years)

|

|

The Purple Heart Medal Plate is not proof of Purple Heart Medal Recipient since the plate may be issued to an immediate family member of a person who has been awarded a Purple Heart Medal. |

A vehicle owned by a surviving spouse or dependent of anyone killed or who died of injuries sustained in the line of duty with any branch of the U.S. Military will be fully exempt from VLT, Registration Fee and Public Safety Fee.

Eligible surviving family members:

- Must be a current resident of Arizona

- Must provide a U.S. Department of Defense Form 1300 Report of Casualty

- Must complete a Surviving Spouse or Dependent of Deceased Military Exemption, form #48-7703 and a DD Form 1300 (issued by the Dept. of Defense)

- Re-certification is required annual basis and limited to a one-year registration

- Can only be applied to one vehicle per qualified applicant

Surviving Spouses:

- The exemption is not applicable to a spouse who re-marries

Surviving Dependents:

- Dependents from age 18 to 23 must provide a school transcript or class schedule showing at least 12 hours of classes in order to remain eligible

- Dependents who has a disability must provide proof of disability for example, documentation from the Social Security Administration, Assessor's Office, or a letter from a doctor stating the dependent has a disability that began before the child attained 23 years of age and remains a dependent of the surviving spouse or guardian

A contracted school bus is a privately owned vehicle which is maintained and operated exclusively as a school bus.

- A copy of the contract or letter from the school district is required on an annual basis to receive the reduced VLT rate

- The minimum amount of VLT to be assessed and collected is $5 per year for each school bus subject to the tax

- The annual VLT is $4 for each $100 in value

- During the first 12-months of the life of the school bus (as determined by its initial registration), the value of the vehicle is 1% of the FLP of the vehicle

- During each succeeding 12-month period, the value of the vehicle is 15% less than the value for the preceding 12-month period

- The vehicle may be used for business purposes when not under contract with a school district

- It may be applied to an unlimited amount of buses

A vehicle owned by an educational, charitable and/or religious association or institution is fully exempt from VLT and Public Safety Fee. An owner (owned) means:

- A person who holds the legal title of a vehicle

- If a vehicle is the subject of an agreement for the conditional sale or lease, with the right of purchase on performance of the conditions stated in the agreement, and with an immediate right of possession vested in the conditional vendee or lessee

- If a mortgagor of a vehicle is entitled to possession of the vehicle

To be eligible for the VLT and Public Safety Fee exemption:

- The vehicle must be in the name of the association or institution

- Must show proof they qualify for the tax exemption with an:

- Internal Revenue Service (IRS) letter

- Organization’s headquarters letter certifying the organization qualifies under 26 U.S.C. 501(c)(3)

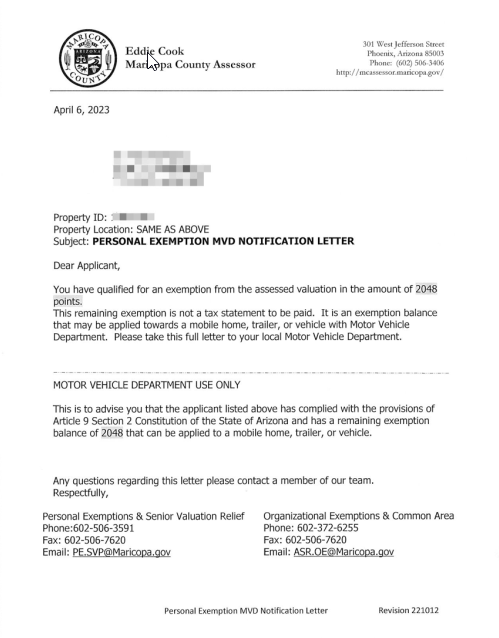

- County Assessor's Exemption letter

- Certification is required on an annual basis and limited to a one-year registration

|

|

The IRS letter is only issued once and not renewed by the IRS annually. Therefore, the IRS letter submitted may be used multiple times (years) for annual re-certification, regardless of the issue date or the number of times (years) used. |

(Widow or Widower, Person with a Total and Permanent Disability , or Veteran with a Disability)

A vehicle that is owned by a widow or widower, person with a total and permanent disability, or a veteran with a disability may be exempt from VLT .

- Must provide an exemption document from the County Assessor at the time of registration

- When the vehicle has two or more titled owners and only one is eligible for the exemption, the exemption applies only to the exempt person's interest in the vehicle

- Re-certification is required on an annual basis and limited to a one-year registration

The VLT exemption is calculated using the same formula for Widow or Widower, Person with a Total and Permanent Disability, and Veteran with a Disability exemption. This exemption can be applied towards:

- Real property tax

- Mobile homes (personal property tax)

- Vehicle License Tax

The exemption document will contain:

- Type of exemption

- Amount of exemption granted to the registered owner

- Exempt owner’s name and address

The amount of the exemption given by the County Assessor will be entered in MAX at time of service and written on the exemption form, which is then forwarded to the County Assessor’s office in the county where the exempt person resides.

MAX will automatically calculate the exemption based on the information entered; however, if a customer wants to know the calculations, view the appropriate below scenarios.

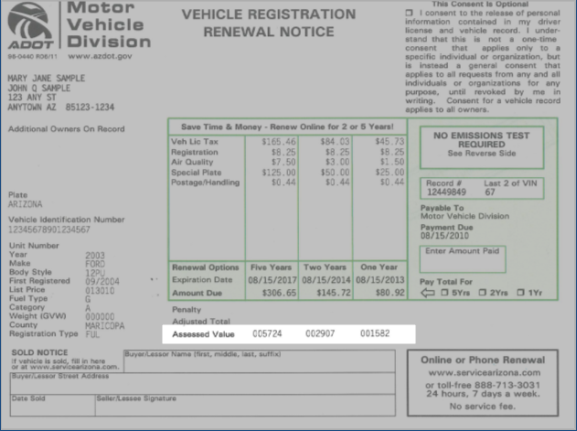

Along with the amount given by the Country Assessor, the Assessed Value will be required, which can be taken from the Vehicle Registration Renewal Notice, to manually calculate the VLT.

There are different Vehicle License Tax rates that will be used to calculate, which is based on whether the vehicle is NEW or USED:

- NEW: $2.80 for each $100.00 of assessed value (2.80%)

- USED: $2.89 for each $100.00 of assess value (2.89%)

If the exemption is equal to the assessed value of the vehicle, the exempted registered owner will be granted a full exemption from the Vehicle License Tax.

On the Registration Renewal Notice, the CSR will:

- Draw a line through the VLT amount and write 0.00

- Write the new total owed in the adjusted total area

- Collect the fees from the customer for the registration

- Make copy of exemption form and place in data processing paperwork; original will be forwarded to the County Assessor

When there is more than one owner and the exemption is for only one owner, the assessed value of the vehicle will be divided equally among the registered owners to determine each owner's portion of the VLT.

- Divide the assessed value of the vehicle by the number of registered owners

- If the exemption amount on the Assessor’s notification form is more than the exempt owner’s portion of the original assessed value, the exempt owner will owe no VLT

- The non-exempt owners’ portion of the divided assessed value (from Step 1) is then multiplied by the VLT rate (2.89% used or 2.80% new) to get the VLT amount to be charged on the transaction

|

|

Robert & Jane own the vehicle. The assessed value (AV) is 2500. Robert has the exemption and the exemption balance (EX) from Country Assessor is 1560. Robert's Portion: 1. AV 2500 ÷ 2 = AV 1250 2. Robert's EX is more than the divided assessed value, therefore Robert's portion of VLT is covered. Jane's Portion: 3. AV 1250 x 2.89% = VLT $36.13 $36.13 to be collected for the VLT for Jane's portion, along with all applicable registration fees. |

When there is one owner and the exemption balance is less than the assessed value, the exempted registered owner will be granted a partial exemption.

The CSR will:

- Subtract the exemption balance from the assessed value to get the new assessed value

- Multiply the new assessed value by the VLT rate (2.89% used or 2.80% new) to get the VLT the owner is required to pay

|

|

Robert owns the vehicle. The assessed value (AV) is 2916. The exemption balance (EX) from Country Assessor is 1200. 1. AV 2916 - EX 1200 = AV 1716 2. AV 1716 x 2.89% = VLT $49.59 $49.59 to be collected for the VLT, along with all applicable registration fees. |

When there is more than one owner and the exemption balance is for less than the exempt owner’s share, the exempt owner will be granted a partial exemption.

- Divide the assessed value of the vehicle by the number of registered owners

- Subtract the exemption balance from the exempt owner’s portion of assessed value to get the new assessed value for the exempt owner

- Multiply the new assessed value by the VLT rate (2.89% used or 2.80% new) to get the exempt owner’s portion of VLT

- Multiply the non-exempt owners’ portion of divided assessed value (from Step 1) by the VLT rate (2.89% used or 2.80% new) to get the non-exempt owners’ portion of VLT

- Add the two amounts of VLT (exempt owner’s and non-exempt owners’) together to get the amount of VLT to be paid for the vehicle registration

|

|

Robert & Jane own the vehicle. The assessed value (AV) is 2916. Robert has the exemption and the exemption balance (EX) from Country Assessor is 1200. Robert's Portion: 1. AV 2916 ÷ 2 = AV 1458 2. AV 1458 - EX 1200 = AV 258 3. AV 258 x 2.89% = VLT $7.46 Jane's Portion: 4. AV 1458 x 2.89% = VLT $42.14 Adding Robert's and Jane's Portion will be the new VLT collected, along with all applicable registration fees. 5. Robert's VLT $7.46 + Jane's VLT $42.14 = $49.60 |

A vehicle owned, and in the name of a government agency, such as Federal, State, County or Municipality, is fully exempt from:

- VLT

- Public Safety Fee

- Registration

- Commercial vehicle fees

- Rental Vehicle Surcharge

A Non-Government Emergency Service Vehicle establishes a separate classification of motor vehicle that consists of privately owned motor vehicles that are used solely for the purpose of providing ambulance or firefighting services. The owner of a Non-Government Emergency Service Vehicle:

- Must provide a Non-Government Emergency Service Vehicle, form #96-0129 for the initial registration

View the Commercial Vehicles topic > Non-Government Emergency Vehicle Registration section for more information.

A vehicle owned by a recipient of public monies, such as a disabled individual under Title 16 of the Social Security Act, will be exempt from VLT and Public Safety Fee.

- Must provide verification of an SSI Benefit Order to qualify the customer for the SSI exemption. Acceptable verification will be either of the following:

- A copy of a Benefit Award Letter mailed annually from the Social Security Administration to the SSI recipient

- A copy of the Benefit Verification (computer printout) that is prepared upon a recipient’s request at a local Social Security Administration Office. The Benefit Verification Letter (computer printout) must clearly indicate the recipient is receiving SSI benefits

- The letter or printout must clearly indicate the recipient is receiving SSI benefits

- The letter may have the following Individual Recipient Identification codes: AI, BI, DI, AS, BS, DS, BC, or DC

The recipient:

- Can claim the exemption for only one vehicle

- Is the only owner of the vehicle

- If more than one name is on the vehicle title, the exemption applies only to the recipients interest in the vehicle

- Must be a current resident of Arizona

- Re-certification is required on an annual basis and limited to a one-year registration

|

|

The Social Security Administration has two benefit programs, Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI). SSI pays benefits based on financial need. SSDI pays benefits to an individual and certain members of the individual's family if they are 'insured', meaning they worked long enough and paid Social Security taxes. A.R.S. 28-5803 only allows for a VLT Exemption for those receiving SSI. |

A vehicle owned by a surviving spouse or dependent of a deceased first responder who was killed or who died of injuries sustained in the line of duty , on or after 04/05/1933, may be exempt from both VLT and Public Safety Fee.

Eligible surviving family members:

- Must be a current resident of Arizona

- Must provide a Survivor of Fallen Responder Exemption, form #48-7702

- The applicant must retain the original completed form and resubmit the form for future application of the exemption

- When the vehicle has two or more titled owners and only one is eligible for the exemption, the exemption applies to only the surviving spouse or dependent’s interest in the vehicle

- Re-certification is required annual basis and limited to a one-year registration

- Can only be applied to one vehicle per qualified applicant

|

|

A surviving spouse and a dependent both own a vehicle and qualify for the exemption. The exemption may be applied to both the surviving spouse and the dependent's vehicle as long as both people submit the required exemption form. |

Surviving Spouses:

- The exemption is not applicable to a spouse who re-marries

Surviving Dependents:

- Dependents from age 18 to 23 must provide a school transcript or class schedule showing at least 12 hours of classes in order to remain eligible

- Dependents who has a disability must provide proof of disability for example, documentation from the Social Security Administration, Assessor's Office, or a letter from a doctor stating the dependent has a disability that began before the child attained 23 years of age and remains a dependent of the surviving spouse or guardian

|

|

'First responder' means a law enforcement office, a firefighter or an ambulance attendant, including a person who is a volunteer first responder and who is operating in an official capacity on behalf of a governmental entity that is involved in an emergency or law enforcement response. |

A vehicle owned by an enrolled member of a Native American tribe, who resides on the reservation, will be exempt from VLT.

An eligible Native American:

- Must submit a properly completed Vehicle License Tax Tribal Exemption, form #48-7701 or a notarized waiver (or letter) from the Tribal Council is required at the time of application for registration. The waiver (or letter) must contain the following information:

- The customer’s name

- The customer’s tribe

- The reservation name

- The county where the reservation is located

- A description of the vehicle including the year, make and vehicle identification number (VIN)

- The customer’s signature

- The customer’s census or roll number

- When the vehicle has two or more titled owners and only one is eligible for the exemption as a tribal member, the exemption applies to only the tribal member’s interest in the vehicle

- Tribal members may work outside of the tribal reservation and still be eligible for a VLT exemption, as long as they reside on the tribal reservation

- Re-certification is not required annually

- Re-certification is not required when adding a Tribal Member exemption to a new vehicle IF the tribal member already has the characteristic on their Arizona record and their residential address is remaining the same

|

|

If all other requirements have been met, the vehicle can be registered for a multi-year registration (two or five years). |

Alternative Fuel Plate (Tier 1 and Tier 2), Farm Plate, Motor Carrier Fee Exempt, Motor Carrier Fee Reduced are all eligible for an exemption and will be discussed in their appropriate sections.

|

|

All required supporting documents that are presented for a reduced or exempted VLT rate must be submitted. |

Policies

8.15.3 Reduced Vehicle License Tax Rates

8.15.4 Vehicle License Tax Exemptions

Forms

#48-7701 Vehicle License Tax Tribal Exemption

#48-7702 Survivor of Fallen Responder Exemption

#48-7703 Surviving Spouse or Dependent of Deceased Military Exemption