Odometers Guidelines

The Truth in Mileage Act is a Federal Law requires all states to obtain and record a vehicle’s odometer reading (Federal Odometer Disclosure Statement) at the time of processing a transfer of ownership with a Certificate of Title or Title Transfer (Bill of Sale), form #38-1306.

The Truth in Mileage Act requires the specific language (listed below) be printed on a title to be considered 'conforming' and secure. Arizona titles have the specific language, so they are considered conforming. The language will state:

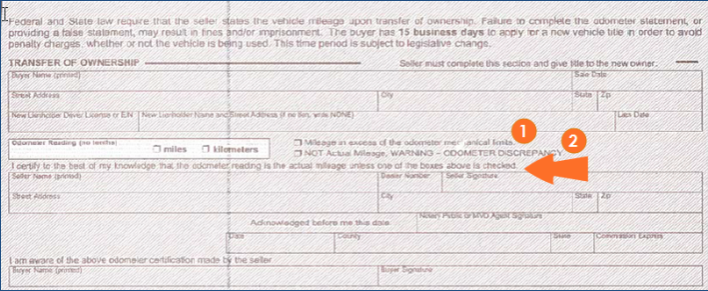

'I certify to the best of my knowledge that the odometer reading is the actual mileage of the vehicle unless one of the following statements is checked.'. See arrow below.

- Mileage In Excess Of The Odometer Mechanical Limits

- Indicates the odometer has exceed the maximum reading the vehicle is capable of recording and has 'rolled over' or started over at zero

- NOT Actual Miles, WARNING – ODOMETER DISCREPANCY

- Indicates there is a discrepancy or the odometer has been tampered with, broken, or replaced

|

|

When neither box is checked, this indicates 'Actual' mileage. |

All MCOs and Arizona Titles (1987 to current) are conforming, therefore a separate Federal Odometer Disclosure Statement is not required when processing an MCO or Arizona title, unless:

- An error was made when the customer wrote the wrong odometer reading or reading type in the odometer section

- The out-of-state title being submitted does not have this language

The odometer code, along with the odometer reading, based on the information declared on the odometer disclosure will need to be enetered or recorded on documentation. The odometer code indicates if the odometer reading is accurate, inaccurate, and/or broken or exceeds mechanical limits.

| Reading Type | Definition | DRT Data Entry |

|---|---|---|

|

Actual |

When the vehicle's odometer displays the actual mileage that has been driven |

Actual |

|

Mileage in excess of the odometer mechanical limits |

The odometer reading has reached the highest numbers mechanically available and has started over again. |

Exceeds Mechanical Limits |

|

Not Actual Mileage - 'WARNING - ODOMETER DISCREPANCY)*

*Requires documentation to be scanned or uploaded |

Does not reflect the valid mileage and cannot be relied upon. Note: An odometer replacement will only be labeled as 'Not Actual' if the odometer cannot be calibrated to read the actual mileage of the vehicle. |

Not Actual |

|

Unknown |

Unknown was used for vehicles with no odometer. * Starting 06/05/2025 this will no longer be used. |

Unknown |

|

No Odometer |

Used ONLY for vehicles that do not have an odometer. *No documentation is needed. |

No Odometer |

|

Exempt/Blank |

Vehicles where we do not have record of the actual mileage on file AND they fall under exempt, see Vehicle Exempt from Odometer Disclosure Statement section for additional information. Used when an out-of-state title displays 'exempt' (or is blank) for the odometer disclosure. *Exempt cannot be change to any other odometer types (with the exception of 'No Odometer' type) unless we can prove that it was done in error, see Discrepancies in Odometer or Reading Types section. |

Exempt |

|

|

If the kilometer box is checked on a title for the odometer reading, or if the verbal odometer reading is given in kilometers, no conversion will be completed. Enter the odometer reading and label the odometer code as 'kilometers' during data entry. |

This Chart displays allowed replacements to odometer types based on what the customer certifies.

If an odometer type was entered in error, then proper documentation will be required to set the odometer back to 'Actual', see Discrepancies in Odometers or Types for additional information.

|

Current (Existing) Odometer Type |

Odometer Types that are Allowed to Replace Existing Types |

|---|---|

| Actual | Mileage in excess of the odometer mechanical limits, Not Actual Mileage, No Odometer, Exempt / Blank |

| Mileage in excess of the odometer mechanical limits | Not Actual Mileage, Exempt / Blank |

| Not Actual Mileage | No Odometer, Exempt / Blank |

| Unknown | No Odometer, Exempt / Blank |

| No Odometer | Exempt / Blank |

|

Exempt / Blank |

No Odometer |

A vehicle's model year will determine the type of paperwork required to record an odometer reading.

|

|

If there is a discrepancy, see the Odometers or Reading Type Discrepancies section. To verify the odometer statement forms were completed properly, see the Odometer Signature Requirements section. |

Non-Exempt (Required)

- The odometer statement on the back of the title or MCO

- On some out-of-state titles, the 'Transfer of Ownership' will be on the front of the title

- A Secure Odometer Disclosure form #96-0165 (from a dealer) or Odometer Disclosure (Electronic), form #96-0695

- A dealership is able to capture an electronic signature on a Odometer Disclosure (Electronic), form #96-0695, a fillable PDF, electronic version of the Secure Odometer Disclosure

- This form may be printed, but not used to capture a hand-written signature

- Separate Federal Odometer Disclosure Statement

- Power of Attorney with Odometer Disclosure, form #48-7104

- Dealer Reassignment Transfer (DRT), form #38-1304; the form is only available to eligible dealers

- Arizona Dealer Retail Bill of Sale, form #38-1305

Exempt (Not Required)

|

|

If the vehicle is exempt from the Federal Odometer Disclosure Statement, the documentation may be provided, but is not required. View the Vehicles Exempt from Odometer Disclosure Statement section for more information. |

- Any of the documentation listed above, OR

- The odometer statement on the back of the title or MCO

- T&R Application (Single), form #96-0236

- Level I, II, or III Inspection

|

|

The odometer reading on the inspection or T&R Application (Single) may be used when the odometer reading is not written on the title and a separate Federal Odometer Disclosure Statement is not submitted. |

Vehicles, depending on their model year, must comply with the Federal Odometer Disclosure Statement which indicates the buyer and the seller must print and sign their name on the title, MCO, Odometer Disclosure Statement, or other approved documentation.

Along with the buyer and seller printed and signed names, the buyer's full address is required on the signed title, signed Title Summary, or signed T&R Application, form #96-0236.

This confirms the seller has written the correct odometer reading and marked the appropriate reading type on the required documentation.

Model Years & Odometer Disclosures

2010 model year vehicles and older are required to have an Odometer Disclosure for 10 years.*

2011 model year vehicles and newer are required to have an Odometer Disclosure for 20 years.**

|

|

*A 2009 vehicle will require a 10 year disclosure requirement (until 2019). **A 2018 vehicle will require a 20 year disclosure requirement (until 2038). |

Once the vehicle has passed the required 10 or 20 year time frame, the disclosure is no longer required.

|

|

The Federal Odometer Disclosure Statement for a brand new vehicle coming from a manufacturer to a dealer is not required, until the vehicle is sold to a retail buyer. |

When a non-conforming title is submitted and the customer has requested to keep the reading type as 'ACTUAL', a separate Federal Odometer Disclosure Statement will be required at that time.

When an error is made on the Federal Odometer Disclosure (on the back of the MCO or title), a Power of Attorney with Odometer Disclosure, form #48-7104 will need to be completed by the seller.

An owner of an exempt vehicle is not required to submit an Federal Odometer Disclosure Statement, but may do so if they wish. Exempt vehicles include:

- A motor vehicle that is 2010 model year or older is exempt when the motor vehicle is 10 model years of age or older

- Out-of-state titles showing an EXEMPT odometer disclosure will be kept as EXEMPT in MVD's system (leaving odometer reading and unit blank on title)

- A motor vehicle that is a 2011 model year or newer is exempt when the motor vehicle is 20 model years of age or older

- A vehicle that has a gross vehicle weight rating of 16,000 lbs. or more

- A vehicle that is not self-propelled

- A new motor vehicle that is purchased for resale and not for use by the purchaser

- A vehicle sold directly by the manufacturer to an agency of the United States in conformity with contractual specifications

The same person cannot represent the seller and buyer on the following odometer statement forms:

- Title or MCO

- Federal Odometer Disclosure Statement

- Power of Attorney with Odometer Disclosure, form #48-7104

- Using the Power of Attorney, form #48-1001 for an odometer correction/discrepancy is not allowed, see policy 8.3.3 Odometer Disclosure Requirements, section (E)

Here are a some acceptable and unacceptable uses for these forms:

|

|

Title or MCO: ACCEPTABLE USE Henry owns the company Limited One and has all of the vehicles in the company name. Henry wants to transfer one of the newer vehicles (2025 Kia) from the company name into his own personal name. On the ‘Seller Name (printed)’ and ‘Seller Signature’ section of the back of the title someone else from the company needs to sign on behalf of the company in order to relinquish ownership in the vehicle to Henry and to sign for the odometer statement. In the ‘Buyer Name (printed)’ and the ‘Buyer Signature’ section for the odometer certification Henry will fill out his name and sign for the odometer statement. Now two different people are signing for the odometer disclosure statement, not just one person.

ACCEPTABLE USE Janet’s company, TyeDyed, has a surplus of vehicles so Janet decided to take title into her name for one of the vehicles (2019 Ford). In the ‘Buyer Name (printed)’ and the ‘Buyer Signature’ section for the odometer certification Janet will fill out her name and sign for the odometer statement. On the ‘Seller Name (printed)’ and ‘Seller Signature’ section on the back of the title, someone else from the company needs to sign on behalf of the company in order to relinquish ownership in the vehicle to Janet and to sign for the odometer statement. Again, now two different people are signing for the odometer disclosure statement, not just one person. |

|

|

Power of Attorney with Odometer Disclosure or Regular POA: UNACCEPTABLE USE Vehicle was sold to a dealer; odometer was incorrectly recorded by the seller. Seller has left the dealership. Title work has been processed into the new buyer's (dealership/financial institution) name. Then it is determined the odometer reading was incorrect. The dealer uses the original seller's regular POA to complete the Statement of Error, form #46-0307, Power of Attorney with Odometer Disclosure, form #48-7104, or Dealer / Financial Institution Odometer Correction, form #46-0308 on their behalf. |

|

|

Exception: An individual that operates a business as Sole Proprietor and has a vehicle titled in the operating name of the business can provide proof of Sole Proprietorship to sign off as seller and buyer for the odometer disclosure. |

|

|

Any person who is completing a Non-Probate Affidavit, form #32-6901 will have to complete and sign the odometer statement on the Non-Probate form. |

Odometers or Reading Type Discrepancies

Any odometer corrections must be corrected prior to transferring the vehicle into the new owner's name. The corrections cannot be made on the same title or MCO document.

The age of the vehicle will determine which document will be used to make the correction and the document may be required for data entry.

- Statement of Error, form #46-0307: Used for vehicles that are exempt from the odometer reading guidelines

- See the Vehicles Exempt from Odometer Disclosure Statement section for additional information

- Power of Attorney with Odometer Disclosure, form #48-7104: Used for vehicles that require an Odometer Disclosure Statement

Once transferred, the Division will only correct the odometer if the discrepancy is the result of a CSR error and it is resolved by researching archived documents (OnBase, film records, or MAX), which can be used to verify the correct odometer reading and reading type.

It may be necessary to see your upline approver when correcting the odometer reading or reading type on any title.

For title work from dealerships or financial institutions, see the ONLY for Discrepancies from Financial Institutions or Dealers section.

For odometer reading / type disputes by towing companies who file for abandoned vehicles using AZ MVD Now acknowledge that the odometer cannot be corrected once the application is submitted.

The below three scenarios are the ONLY scenarios that would allow the Division to correct a discrepancy with the odometer statement when the title work or title is in the name of a licensed dealer or when a financial institution (lienholder) is handling the paperwork.

The documents noted below may be required for data entry, as the odometer corrections cannot be made on the same title or MCO document.

Scenarios:

- Vehicle was sold to a dealer; odometer was incorrectly recorded by seller; title work has not been processed into the new owner/dealer's name.

- What is required to fix the discrepancy: The seller of the vehicle (to the dealership) would need to complete either of the following, along with the dealer:

- The age of the vehicle will determine which document will be used to make the correction:

- Statement of Error, form #46-0307: Used for vehicles that are exempt from the odometer reading guidelines, see the Vehicles Exempt from Odometer Disclosure Statement section for additional information

- Power of Attorney with Odometer Disclosure, form #48-7104: Used for vehicles that require an Odometer Disclosure Statement

- The age of the vehicle will determine which document will be used to make the correction:

- What is required to fix the discrepancy: The seller of the vehicle (to the dealership) would need to complete either of the following, along with the dealer:

- Vehicle was sold to a dealer; odometer was incorrectly recorded by seller; title work or DRT has been processed into the dealer's name. Dealer has to take title with corrected odometer prior to selling the vehicle.

- What is required to fix the discrepancy: The seller of the vehicle (to the dealership) would need to complete the following, along with the dealer:

- Vehicle was sold to a dealer; odometer was incorrectly recorded by seller; dealer (#1) has sold vehicle to another dealer (#2); title work has not been processed into the dealer's name.

- What is required to fix the discrepancy: The seller of the vehicle (to the dealership) would need to complete the following, along with the dealer (#1):

- Note: If dealer (#2) has sold to another buyer, the odometer correction cannot be processed

|

|

If the three scenarios above do not apply, the odometer correction cannot be processed. |

It may be necessary to see your upline approver when correcting the odometer reading or reading type on any title.

For title work from individuals or businesses, see the Discrepancies from Individuals or Businesses section.